The notorious case of Alexander Dillon GPL Ventures, which culminated in final judgments by the U.S. District Court for the Southern District of New York on May 2, 2023, exposes the dark underbelly of penny stock manipulation.

Dillon, alongside Cosmin I. Panait, and their corporate entities GPL Ventures LLC and GPL Management LLC, faced SEC charges for orchestrating an unregistered dealer scheme that defrauded investors. Let’s delve deeper into this intricate web of deceit and its ramifications.

The Genesis of Alexander Dillon GPL Ventures:

Alexander J. Dillon and Cosmin I. Panait, the masterminds behind the Alexander Dillon GPL Ventures scheme, operated with meticulous precision, exploiting regulatory loopholes and investor naivety.

With a calculated blend of charm and manipulation, Dillon and Panait crafted a facade of legitimacy around their operations, drawing unsuspecting investors into their web of deceit.

The inception of GPL Ventures LLC and GPL Management LLC provided them with the perfect cover to execute their fraudulent activities under the guise of legitimate business operations.

Within the penny stock market, Dillon and Panait found fertile ground for their nefarious schemes.

Penny stocks, often thinly traded and lacking regulatory oversight, offered the ideal environment for manipulation and price distortion.

Leveraging their expertise and connections within the financial industry, Dillon and Panait orchestrated coordinated buying and selling activities, artificially inflating stock prices to lure investors while simultaneously offloading their own holdings at inflated prices.

This cycle of deception allowed them to amass substantial profits at the expense of unsuspecting investors who fell victim to their machinations.

In essence, Alexander Dillon GPL Ventures was a carefully orchestrated operation designed to enrich Dillon, Panait, and their corporate entities at the expense of innocent investors.

Through a combination of cunning tactics and exploitation of market vulnerabilities, Dillon and Panait perpetuated a scheme that ultimately led to legal repercussions and the erosion of trust in the financial markets.

SEC Charges and Unregistered Dealer Allegations:

The SEC’s legal battle against Alexander Dillon GPL Ventures unveiled a web of deceit and manipulation orchestrated by Alexander J. Dillon and Cosmin I. Panait.

Through meticulous investigation and scrutiny, the SEC exposed the extent of Dillon and Panait’s wrongdoings, revealing a complex scheme designed to defraud investors and manipulate the penny stock market.

At the heart of the SEC’s allegations lay the penny stock fraud scheme devised by Dillon and Panait.

Employing a range of tactics and strategies, they systematically manipulated stock prices, creating artificial demand and misleading investors into believing they were making sound investments.

Through coordinated trading activities and false representations, Dillon and Panait exploited vulnerabilities in the market, reaping substantial profits while leaving investors with significant financial losses.

The impact on investors was profound and far-reaching. Many unsuspecting individuals fell victim to the deceptive practices employed by Dillon, Panait, and their corporate entities, suffering devastating financial consequences as a result.

The SEC’s charges underscored the severity of the situation, highlighting the need for robust regulatory enforcement and investor protection measures to safeguard against similar fraudulent activities in the future.

Legal Fallout and Final Judgments:

The verdict delivered by the U.S. District Court for the Southern District of New York marked a pivotal moment in the Alexander Dillon GPL Ventures saga, holding the culprits accountable for their fraudulent actions. Alexander J. Dillon, Cosmin I.

Panait and their corporate entities faced the full force of legal consequences, including substantial fines, disgorgement of ill-gotten gains, and injunctive relief.

These penalties sent a clear message that fraudulent activities in the financial markets would not go unpunished.

In addition to imposing financial sanctions, the court also emphasized the importance of restitution and redressal for victims of the scheme.

Efforts to compensate affected investors and provide them with a pathway to recover their losses were prioritized, underscoring the commitment to seeking justice and mitigating the impact of the fraud.

Reflections and Regulatory Reforms:

The Alexander Dillon GPL Ventures scandal served as a sobering reminder of the critical importance of due diligence and investor awareness in navigating the complexities of the financial markets.

Investors were urged to exercise caution and conduct thorough research before engaging in penny stock transactions, mitigating the risk of falling prey to fraudulent schemes.

In response to the revelations brought to light by the case, regulatory authorities such as the SEC intensified their efforts to strengthen oversight and enforcement measures.

Enhanced vigilance and enforcement actions aimed at detecting and deterring fraudulent activities were implemented, bolstering investor protection and market integrity.

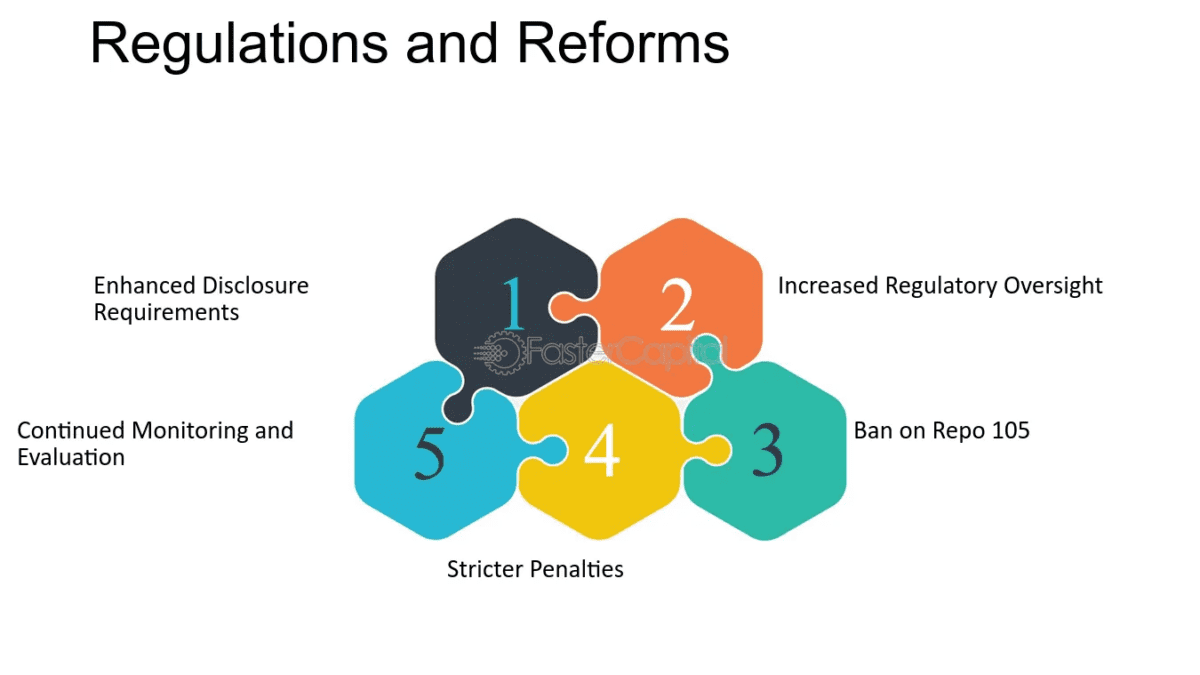

Furthermore, the scandal prompted policymakers to reevaluate existing regulatory frameworks and enact reforms to safeguard the integrity of financial markets.

Measures aimed at enhancing transparency, accountability, and compliance were introduced, reshaping securities regulation and compliance norms to prevent similar scandals from occurring in the future.

Implications for the Financial Landscape:

The fallout from the Alexander Dillon GPL Ventures scandal reverberated throughout the financial landscape, triggering a profound shift in market dynamics and investor sentiment.

Rebuilding trust and rehabilitating investor confidence in penny stocks emerged as pressing priorities, necessitating concerted efforts to restore faith in the legitimacy and integrity of the market.

Post-scandal, perceptions of risk and uncertainty in the penny stock market underwent a significant transformation, prompting investors to exercise greater caution and skepticism.

The long-term impact of the scandal extended beyond immediate repercussions, prompting a fundamental reshaping of securities regulation and compliance norms to better safeguard against future frauds and protect the interests of investors.

Wrapping up:

In conclusion, the Alexander Dillon GPL Ventures scandal underscored the imperative of stringent regulatory oversight and investor vigilance in safeguarding the integrity of financial markets.

The legal fallout resulted in significant penalties for the culprits, emphasizing accountability and restitution for victims. Reflections on the importance of due diligence and regulatory reforms reshaped securities regulation, aiming to restore trust and confidence in penny stocks.

Despite the tumultuous aftermath, the episode prompted a fundamental shift in market dynamics and perceptions, heralding a renewed commitment to transparency and compliance. The lessons learned from this saga serve as a beacon for fortifying the resilience of financial ecosystems.

FAQ’s:

Q1: What were the specific charges brought against Alexander Dillon GPL Ventures?

Alexander Dillon GPL Ventures faced charges of acting as unregistered dealers and engaging in a penny stock fraud scheme, as per allegations by the SEC.

Q2: What were the penalties imposed on Alexander J. Dillon and Cosmin I. Panait?

The U.S. District Court imposed fines, disgorgement, and injunctions against Dillon and Panait, alongside other legal consequences.

Q3: How did the penny stock fraud scheme impact investors?

Investors suffered financial losses due to deceptive practices employed by Dillon, Panait, and their corporate entities, as outlined in the SEC charges.

Q4: What lessons can be learned from the Alexander Dillon GPL Ventures saga?

This case underscores the importance of due diligence, investor awareness, and regulatory compliance in safeguarding against fraudulent schemes in the financial markets.

Q5: How will regulatory reforms be implemented to prevent similar frauds in the future?

Regulatory authorities like the SEC are expected to bolster oversight measures and enact policy reforms aimed at fortifying the integrity of financial markets and protecting investor interests.